If you are in a place where you need some extra money, a personal loan may be able to help. It is always a good idea to understand a financial product – and how it may impact you in the future – before you take it out. Keep reading to learn more about personal loans, how they can impact your tax return, and how you can qualify for a personal loan.

What is a Personal Loan?

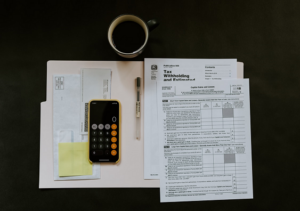

A personal loan is typically small, short-term, and not attached to a specific item. A mortgage is used to purchase a house. A car loan is used to purchase a vehicle. Student loans are supposed to pay for school-related expenses. A personal loan is more flexible because you can decide how to spend the money. Before you take out any type of loan it is important to remember that some types of loans have tax implications. If you are thinking about getting a personal loan, it is important to understand if/how it will impact your tax return before you take one out.

Do Personal Loans Affect Your Tax Return?

In the vast majority of situations, personal loans do not affect your tax return. You do not have to count the loan as income on your tax return because you have to pay it back. And, since a personal loan is designed to be used for personal expenses, there are no write-offs or tax advantages to getting a personal loan. As long as you use a personal loan as intended and pay it off as planned, there will be no impact on your tax return. There are very few situations where a personal loan will affect your tax return. If you have any concerns at all, it is wise to reach out to a tax professional and double-check about your specific situation.

How Can You Qualify for a Personal Loan?

The specifics for qualifying for a personal loan vary depending on the place you choose for the loan. At Tio Rico, you can get approved for a personal loan in as little as thirty minutes as long as you meet some basic qualifications. You must 18 years old or older, need to borrow between $100 and $1,000, and have a government-issued ID. If you can show that you have an Arizona motor vehicle registration in your name, a checking account, paystub from an employer, and a debit card then you have what you need to get qualified for a personal loan from Tio Rico.

It is wise to consider how your financial decisions will impact your tax return. When it comes to getting a small personal loan, there will be no impact on your tax return. If you are ready to get the loan process started, visit a Tio Rico location near you.